Get the best practices in cannabis accounting

Get clear on cannabis taxes, accounting compliance and how to work with cannabis clients as an accounting professional

Featured in

Cannabis accounting is different and nuanced.

The cost of not knowing the cannabis state regulations, cannabis taxes, and best practices in handling an all-cash business could lead to fines, penalties, and cash flow issues down the road.

Cannabis businesses must have a solid accounting strategy and need to focus on managing cash flow, and inventory, all while staying competitive in a highly regulated market.

Get clear on the best practices to building a strong financial foundation

Cannabis accounting is different and nuanced. To be successful in cannabis accounting, a business must have a strong financial foundation, a clear understanding of the local, state, and federal taxes, and a cash flow strategy.

With strict regulations from state regulators and extra requirements from the IRS, it's important that business owners and the finance responsible embrace cannabis accounting and accounting best practices.

Get the tools to level up your cannabis expertise and confidently get up to speed on the nuances of working in cannabis and how to navigate cannabis accounting, regulation, and compliance.

A deep overview of cannabis taxes and best practices to minimizing the tax burden

Best Practices in Financial Procedures for a Cannabis Business

Feel prepared for operating in an all cash environment

Feel confident about the IRS requirements for cannabis businesses

Best practices in onboarding cannabis clients

Get practices in inventory, cash management, fixed assets, and more!

Get introduced to how and why cannabis accounting is different

Get clear on cannabis regulation and taxes

Get Industry Specific Chart of Accounts and SOPS

Get the roadmap to making sure you cover EVERYTHING in your client onboarding

An on-demand, online course to help you upskill your cannabis accounting and compliance expertise

The Cannabis Industry Needs you!

Course Outline + Course Downloads

Do you want to work with cannabis clients?

My Cannabis Story, and How I got involved

The Controlled Substance Act

Risks of Working in Cannabis

Adult Use vs. Medical Use

Plant Touching vs. Ancillary Providers

Cannabis Licenses (Plant Touching)

Cannabis Business can operate with a Bank Account

Cannabis Startup and Operating Costs

Cannabis Regulation

Common Areas of Regulation

Master your Regulation - Activity

Seed to Sale Tracking

Insurance Requirements

Record Requirements

Cannabis Violations and Its impact on Accounting

State and Local Cannabis Taxes

Sales and Use Tax

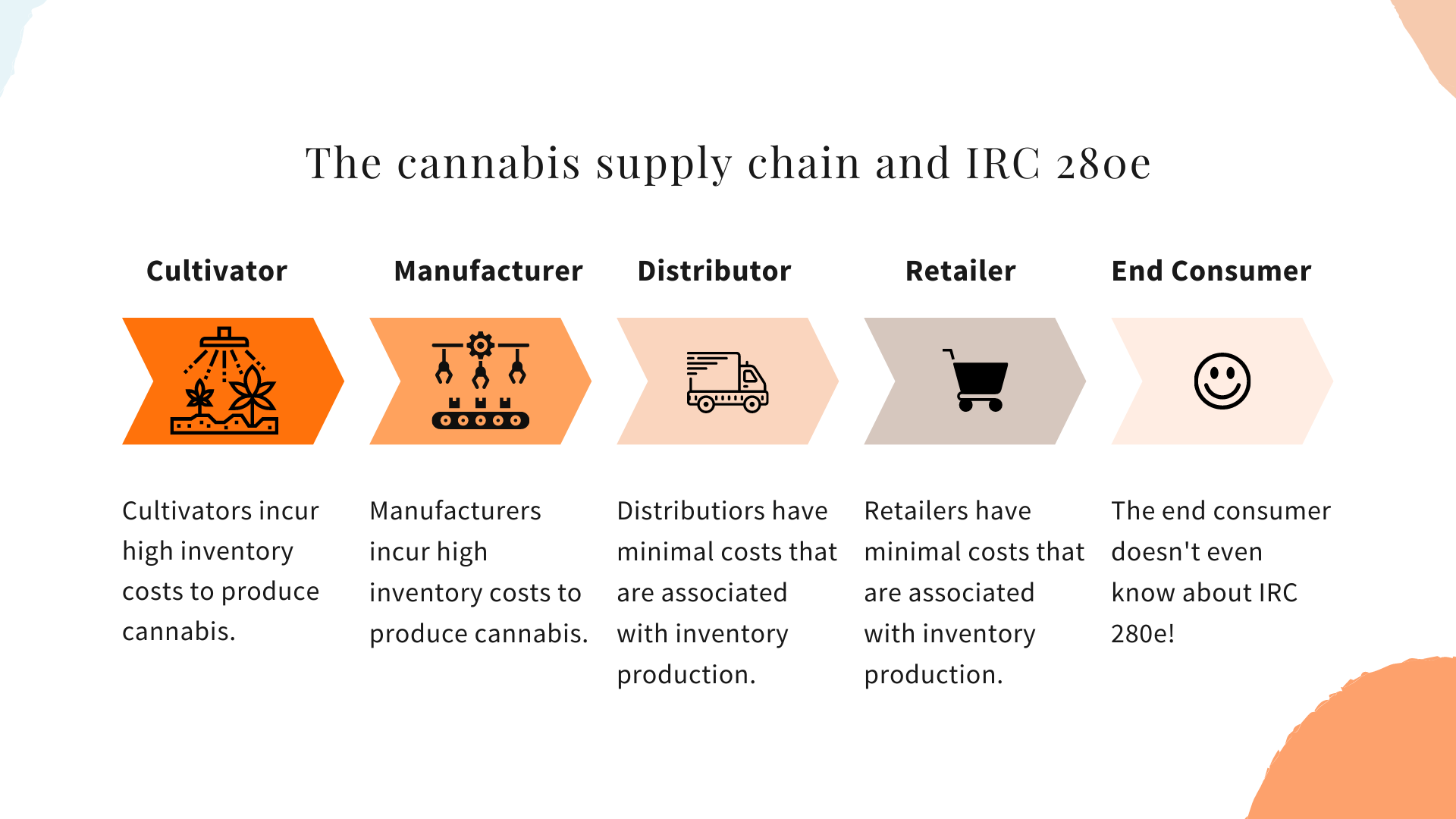

A deep dive into IRC 280e

Cannabis Federal Deductions

How 280E Applies to a cannabis business

Tax Case Findings Summary

The History of IRC 280E- >Jeffery Edmundson

The Case for COGS Deductions and Separate Trades or Businesses -> (CHAMP)

The importance of Receipts and 75.6% COGS --> Olive vs. Commissioner

Cannabis Losses (Beck vs. Commissioner)

Management Companies (Alternative Health Care Advocates versus Commissioner)

Cannabis Excise Tax Memo

Section 471 Memo

The Lesson of For Profit vs. Not for Profit -> Canna Care vs. Commissioner

Cash vs. Accrual Accounting

Inventory Costs for Cannabis Businesses

Freight in and Freight Out

How the IRS Calculates COGS

Section 471 of the IRS Code

Single Legal Entity

Multiple Legal Entities

Other Accounting Strategies

280e Allocations Template

Allocations Case Example - Mary

Rent Allocations

Labor Allocations

Allocations with Multiple Revenue Streams

Quarterly Tax Estimator

Journal Entry for Allocation

Audit Proof your Allocations

Year End Inventory (what's included/excluded)

Owner Distributions after Taxes

Cannabis Chart of Account Template

Create a Strategic Chart of Accounts for a Cannabis Business

Accounting Systems

Inventory Management Systems and Accounting Considerations

Setting up a Customer List

Setting up a Vendor List

Product Listing

Get up to speed with these workpapers, process control questions, and checklists

IRC 280e Calculation Tools and Checklists

Cash Control Checklist

Inventory Control Checklist

Onboarding a New Cannabis Business Checklist

Questions to ask when assessing the purchases process in the business

Questions to ask when assessing the accounting process in the business

Questions to ask when assessing the inventory process in the business

Questions to ask when assessing the cash process in the business

Period End Checklist

This program is for you if you will be responsible for cannabis or hemp accounting and compliance. If you're a bookkeeper, accountant, compliance consultant, or employee in operations and accounting, it's time to take action!

Imagine having a finance and compliance roadmap, templates, and checklists, delivered directly to you. You’ll have access to hundreds of hours spent consulting business owners, creating business solutions for businesses in cannabis, manufacturing, agriculture, and retail delivered directly to you.

When you enroll in the training, you will have instant and LIFETIME access to the training and course modules. You'll have access to participate in our online community group and ask questions on our group forum.

I've been working in regulated cannabis since 2015