Get clear on Cannabis Accounting and Taxes

Get up to speed on what you need to know in cannabis accounting

Featured in

Cannabis accounting is different and nuanced.

The cost of not knowing the state and federal taxes, cannabis compliance, and best practices in handling an all-cash business could lead to fines, penalties, and cash flow issues down the road.

Cannabis businesses must have a solid accounting strategy and need to focus on managing cash flow, inventory, all while staying competitive in a highly regulated market.

It's important to have a constant stream of capital moving through the business. The way you can do this? Through building a profit strategy.

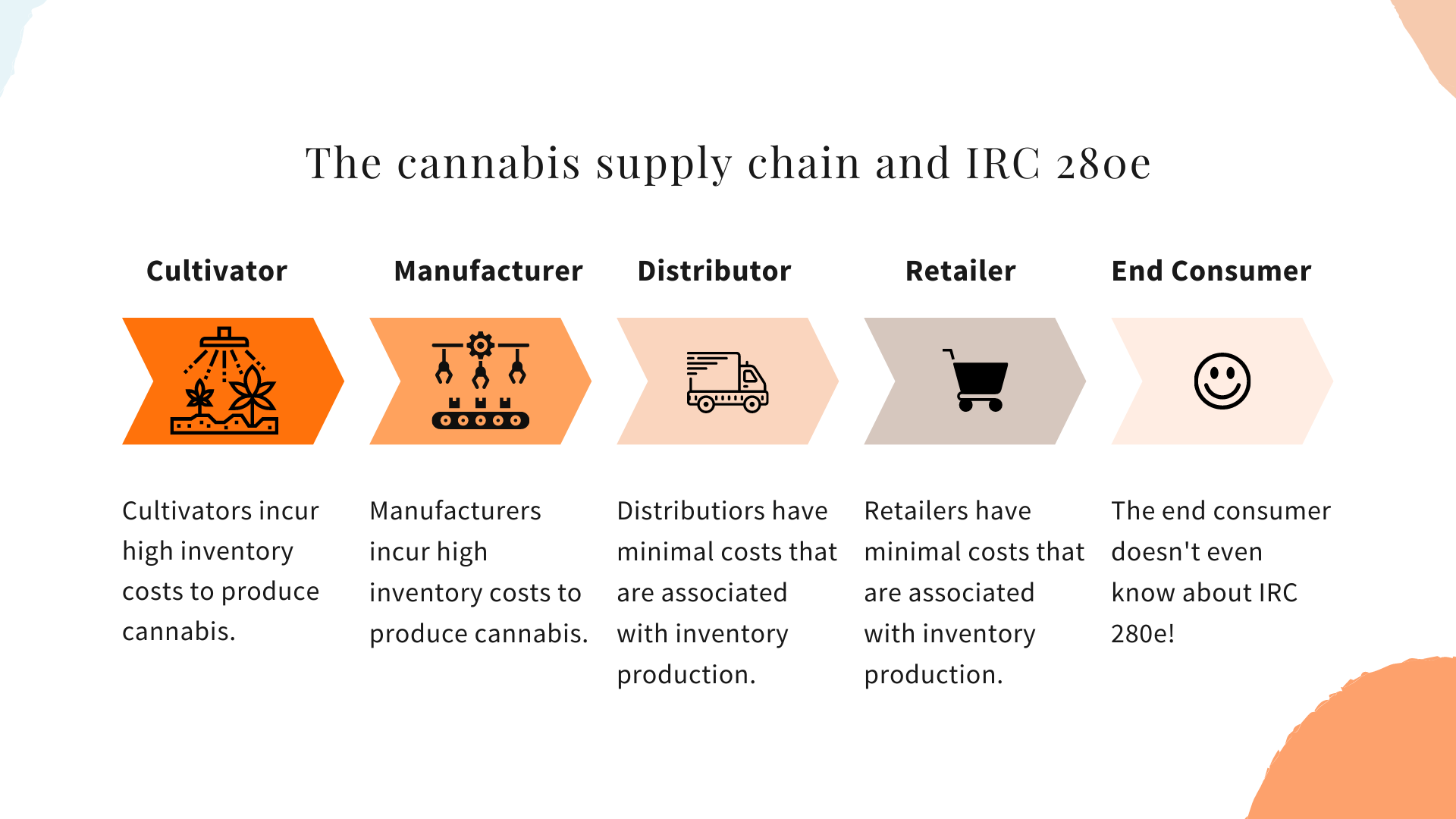

Cannabis Business have different federal tax obligations (IRC 280e)

Cannabis businesses pay state and Local Cannabis Taxes

Most cannabis work in all cash and have IRS reporting requirements

Cost Accounting is a pillar for cannabis cultivators and manufacturers

Cannabis businesses need good inventory management systems and practices

Cannabis businesses need good financial Controls

Cannabis business are required to track all cannabis on the seed to sale tracking systems

Let's face it. A highly regulated, emerging industry, high growth, high taxes, and it's still not federally legal. In such a nascent and emerging industry, cannabis businesses need highly skilled accountants to help them plan, grow and scale.

Whether it's tax planning, capital raises, daily bookkeeping, or financial oversight, your cannabis business will need a skilled accountant.

Get the tools to level up your cannabis expertise and confidently get up to speed on the nuances of working in cannabis and how to navigate cannabis accounting, regulation, and compliance.

A deep overview of cannabis taxes and best practices to minimizing the tax burden

Best Practices in Financial Procedures for a Cannabis Business

Feel prepared for operating in an all cash environment

Feel confident about the IRS requirements for cannabis businesses

Inventory Controls and Best Practices

Best practices in onboarding cannabis clients

Get up to speed with these workpapers, process control questions, and checklists

IRC 280e Calculation Tools and Checklists

Cash Control Checklist

Inventory Control Checklist

Onboarding a New Cannabis Business Checklist

Questions to ask when assessing the purchases process in the business

Questions to ask when assessing the accounting process in the business

Questions to ask when assessing the inventory process in the business

Questions to ask when assessing the cash process in the business

Period End Checklist

This program is for you if you will be responsible for cannabis or hemp accounting and compliance. If you're a bookkeeper, accountant, compliance consultant, or employee in operations and accounting and need a high-level view of cannabis accounting strategy, it's time to take action!

Imagine having a finance and compliance roadmap, templates, and checklists, delivered directly to you. You’ll have access to hundreds of hours spent consulting business owners, creating business solutions for businesses in cannabis, manufacturing, agriculture, and retail delivered directly to you.

When you enroll in the training, you will have instant and LIFETIME access to the training and course modules. You'll have access to participate in our online community group and ask questions on our group forum.

If you're thinking about being an accountant in cannabis, check out the tax guide!

+5 Years of Operating in Regulated Cannabis